-

-

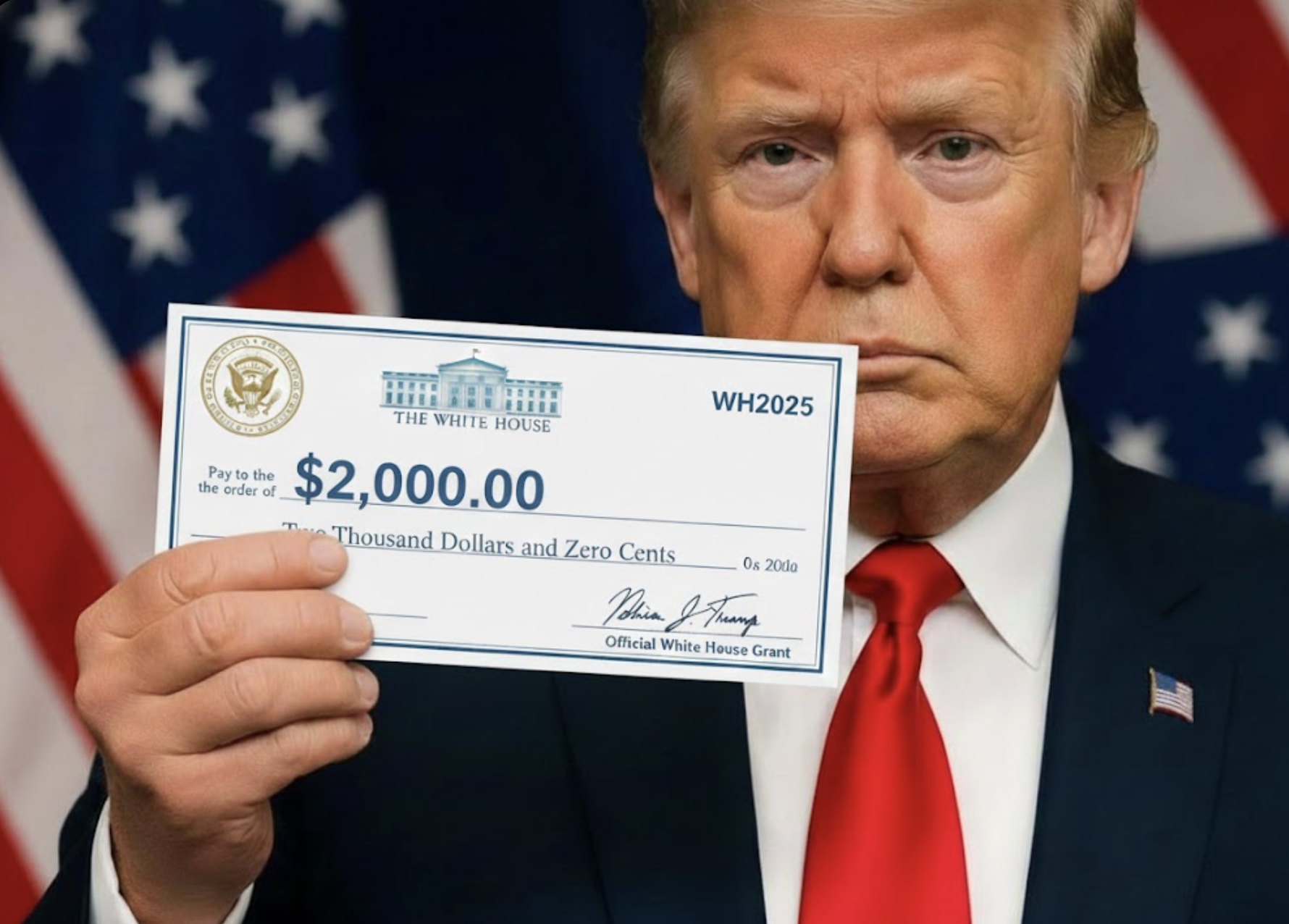

The White House says Trump is still committed to paying the $2,000 dividend from tariff revenue. Reuters

-

Press Secretary Karoline Leavitt confirmed they’re actively “exploring how to make it work.” Reuters

-

-

Timeline

-

Trump is promising the checks to start around mid-2026. Axios+1

-

But that depends on legislation: Treasury Secretary Scott Bessent said Congress must pass something for the checks to be made. Politifact+1

-

-

Income Cap Discussion

-

There’s talk of limiting eligibility: Bessent hinted that only families earning under $100,000/year might qualify. New York Post

-

That cap is not finalized yet — it’s still under discussion. New York Post+1

-

-

Risk & Uncertainty

-

Analysts say the payout would require Congressional approval; without it, the plan is just a proposal. Politifact

-

Some of the tariffs that would fund this are under legal challenge, making the plan riskier. The Washington Post

-

The CBO (Congressional Budget Office) now estimates that tariffs will reduce the deficit by $1T less than previously expected — which complicates how much “extra” money is available for the checks. Axios

-

-

IRS Warning

-

The IRS confirmed: there are no new authorized $2,000 stimulus checks right now. mint+1

-

This means any posts or social-media claims promising this money immediately are not backed by an IRS program at the moment. Hindustan Times+1

-

-

Use of “Leftover” Funds

-

Trump has said that after paying the checks, leftover tariff revenue could go toward paying down the national debt. Reddit

-

Bessent also suggested some of the “dividend” could come in forms other than checks — for example via tax relief (tips, overtime, Social Security) rather than a straight payout. Reddit

-

He also encouraged people to save rather than spend the checks, citing concerns about inflation. Reddit

-

1. White House Commitment

Bottom Line — Right Now

-

The $2,000 tariff-check is still a proposal, not guaranteed.

-

There’s a timeline (mid-2026), but the mechanism is not locked in — it might be checks, tax cuts, or something mixed.

-

Congressional approval is needed, so nothing is final.

-

No checks are going out currently — the IRS confirmed that.

-

There are significant financial and legal risks, so this plan could be delayed, altered, or even scrapped.